MCS study „Analysis of the palm oil market in Germany in 2019“ is published!

Palm oil as an agricultural raw material is of key significance to producing and consuming countries and plays an important role in their economies, especially in rural areas. It has many properties that make it a vital part of critical processing operations and is therefore considered indispensable in some industries. However, unsustainable palm oil production has serious local and global implications. [1]

The study “Analysis of the palm oil market in Germany in 2019”, conducted by Meo Carbon Solutions on behalf of the German Forum for Sustainable Palm Oil (FONAP ), has analyzed current German market data on the direct and indirect consumption of sustainable and non-sustainable palm oil and palm kernel oil based products. For this purpose, the palm oil market was divided into five sectors in which palm oil and palm kernel oil are consumed or used as components of products: food, feed, detergents, cleaning agents (WPR) and cosmetics , energetic and chemical/pharmaceutical applications.

The challenge of this study was to collect meaningful data on the palm oil market in 2019. Furthermore, it had to be ensured that the data of the current study were comparable with the previous surveys for the years 2013, 2015 and 2017. In order to get the data , companies, market experts, associations and institutions were contacted and interviewed , in addition, a webinar with market experts was held. All available statistical information, publications of organizations, associations, scientific studies and product information were also systematically evaluated and supplemented or compared with the available information from the structured interviews.

If you are interested in further information and details click here for the full study or the summary in German or English .

Summary of results

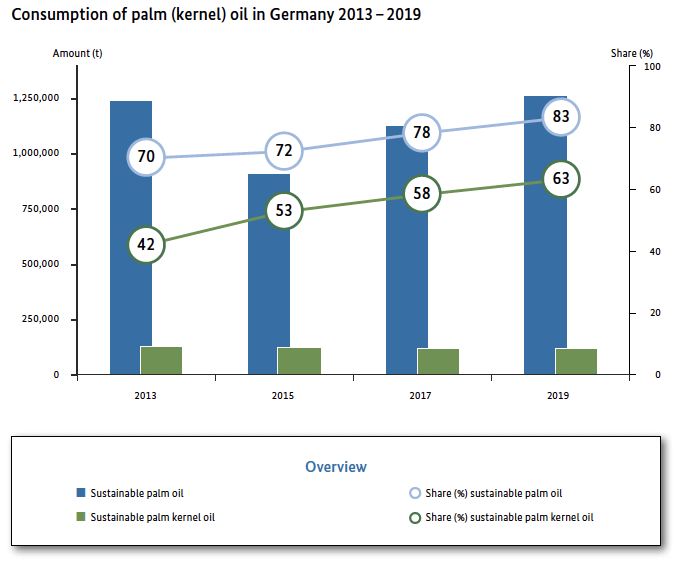

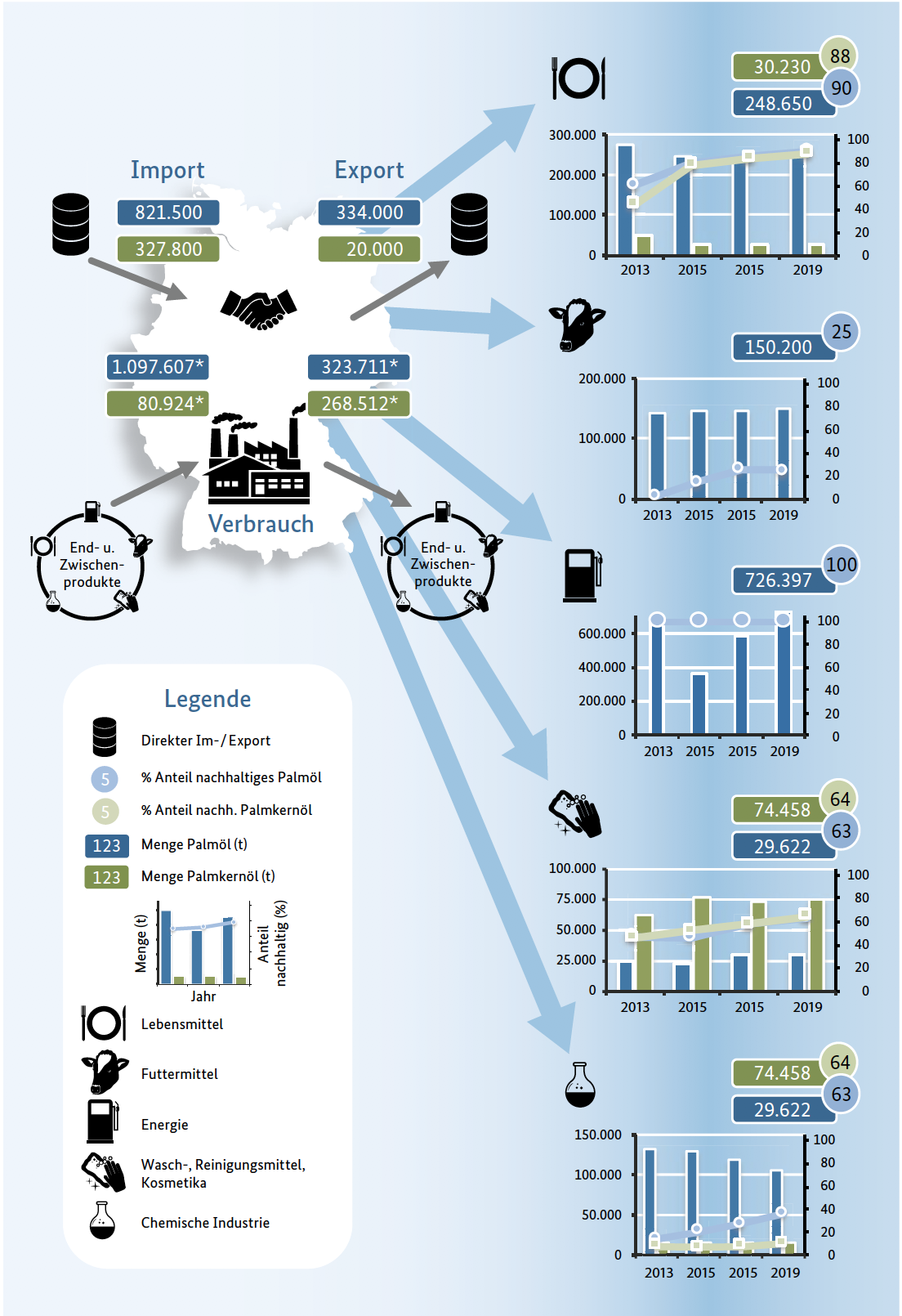

The results of presented research shows that in all four non-energy sectors the share of sustainable palm (kernel) oil has continuously increased. (by 5% compared to 2017 and amounted to 83% for palm oil and 63%, for palm kernel oil). Total oil consumption in Germany in 2019 was 1.26 million tons of palm oil and 120,212 tons of palm kernel oil. Palm oil consumption increased by more than 100,000 tonnes compared to the 2017 study, while palm kernel oil consumption increased by less than 1%. Furthermore, the number of companies that are certified to one of the standards recognized by FONAP has increased steadily in recent years.

Having a closes look to the five sectors, the share of sustainable palm oil increased in the food sector by 5 percentage points since 2017 to a total of 90%, in the detergents, cleaning agents and cosmetics sector (+ 1 percentage point to a total of 63%) and chemical and pharmaceutical sector (+ 9 percentage points to 63%), the sustainable share of palm oil was also increased, whereas a slight decrease was measured in the animal feed sector (–1 percentage point to 25%). The consumption of sustainable palm kernel oil by sectors in 2019 was as follows: food – 88%, chemicals/pharmaceuticals – 64%, cleaning products & cosmetics – 64%.

Summing up , the share of sustainable palm and kernel oil in Germany continuously increased since the first study in 2013. Sustainable palm oil increased from 70% to 83%, palm kernel oil increased from 42% to 63%. This is a great success and significant increase in the consumption of sustainable palm (kernel) oil. However, the current figures also show that the goal set by FONAP of 100% use of sustainable palm (kernel) oil in Germany will not be achieved in 2020. Despite the successful work of FONAP, the consumption of sustainable palm (kernel) oil in the feed and chemical / pharmaceutical sectors is still well below expectations in 2019. This is mainly due to the fact that consumers are often not aware that palm (kernel) oil is contained in individual sectors, segments and products. Therefore, as one of recommendation, there should be more “educational work” for consumers and companies to show them the importance of palm oil in the production and to what extent sustainable palm (kernel) oil represents a significant added value. Another important point from the authors‘ point of view is the area of public procurement. This is a missed opportunity for the federal, state and local governments to strengthen demand and awareness for products with sustainable palm (kernel) oil.